Climate change is one of the biggest threats to our planet. To combat it, we need to take action now. This is where climate finance comes in. Climate finance encompasses funding mechanisms that mobilize resources for renewable energy projects, climate mitigation initiatives, and other sustainability-focused endeavours. Providing funds for climate-related projects, it can empower communities to make a positive impact. In this article, we’ll explore the role of climate finance in empowering climate action. We will discuss how it can be leveraged to accelerate the transition to a sustainable future.

What Is Climate Finance?

Climate finance refers to the financing mechanisms put in place to address the challenges of climate change. It encompasses a broad range of activities, including funding for renewable energy projects, clean transportation, and other climate mitigation and adaptation initiatives.

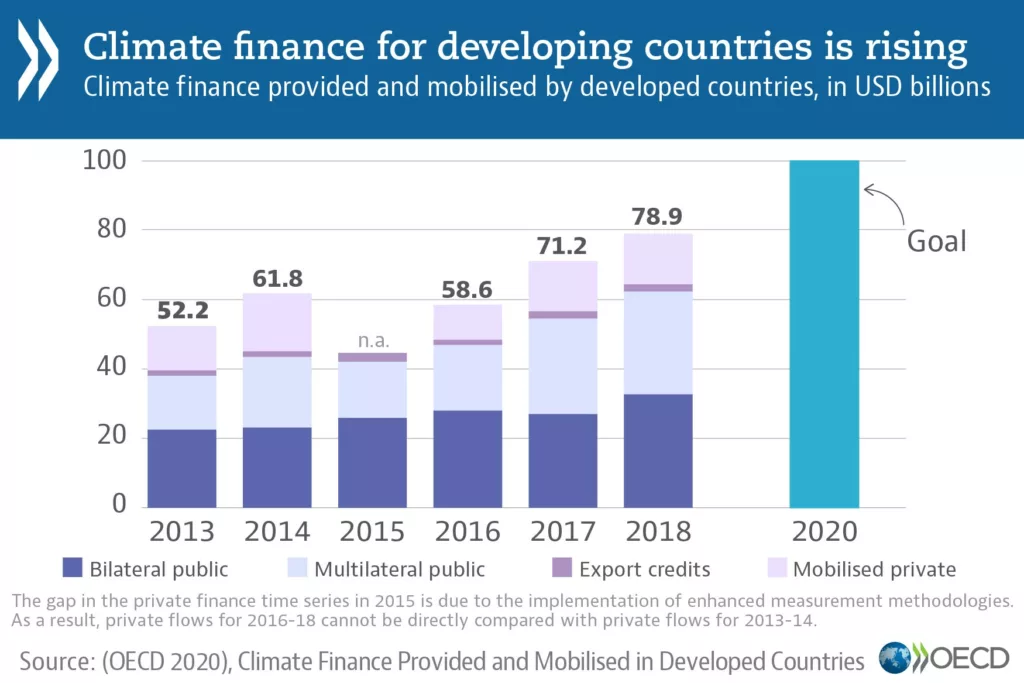

Governments, international organizations, and private investors can provide climate finance. It is directed towards developing countries that are most vulnerable to the impacts of climate change.

A climate finance course can provide a comprehensive understanding of the key concepts and principles of climate finance. It includes sources of funding, financing mechanisms, and policy frameworks. It can also cover the challenges and opportunities associated with climate finance.

By taking a climate finance course, individuals can gain the knowledge and skills needed to play a meaningful role in the fight against climate change.

Importance Of Addressing Climate Change Through Finance

Climate finance in India has become increasingly important as the country faces a range of climate-related challenges, including rising temperatures, water scarcity, and extreme weather events. To address these challenges, India has set ambitious targets for renewable energy deployment and is actively seeking climate finance from international sources to support these efforts.

The importance of addressing climate change through finance cannot be overstated. Here are several key reasons highlighting its significance:

- Mobilizing Resources: Climate change requires substantial investments to mitigate greenhouse gas emissions and adapt to its impacts. Climate finance plays a crucial role in mobilizing financial resources at a scale necessary to tackle the global climate challenge. It helps bridge the gap between the funds needed and the resources available, unlocking the necessary capital for climate-related projects and initiatives.

- Scaling Up Climate Action: Adequate finance is essential for scaling up climate action. It enables the implementation of renewable energy projects, energy-efficient technologies, sustainable transportation systems, and other climate-friendly solutions. By providing the necessary funding, climate finance accelerates the transition to a low-carbon economy, helping to achieve emission reduction targets and sustainable development goals.

- Supporting Developing Countries: Developing countries often face the greatest challenges posed by climate change, despite having contributed less to global emissions historically. Climate finance plays a critical role in supporting these countries in their efforts to mitigate and adapt to climate change. It provides financial resources, capacity-building support, and technology transfer, helping developing nations transition to sustainable development pathways and enhance their resilience to climate impacts.

- Promoting Equity and Justice: Climate change exacerbates existing social and economic inequalities, disproportionately affecting vulnerable communities and marginalized populations. Climate finance can address these inequalities by directing resources to those most in need and ensuring that all communities have access to climate solutions. It helps promote equity, justice, and inclusive development by prioritizing the needs and rights of vulnerable groups.

- Unlocking Private Sector Investment: Climate finance acts as a catalyst for private sector investment in climate solutions. By providing financial incentives, risk mitigation measures, and policy frameworks, climate finance encourages businesses and investors to allocate capital toward sustainable projects. This unlocks additional financial resources and drives innovation, fostering the growth of green industries and accelerating the transition to a low-carbon economy.

- Advancing Sustainable Development: Climate change is intricately linked to sustainable development goals, including poverty eradication, access to clean energy, sustainable agriculture, and resilient infrastructure. Climate finance supports the integration of climate action with broader development objectives, ensuring that climate investments contribute to sustainable and inclusive growth. By aligning finance with sustainable development, climate finance promotes holistic solutions that address the interconnections between environmental, social, and economic dimensions.

- Fostering International Cooperation: Climate finance is a key component of global climate governance and promotes international cooperation. It facilitates collaboration between developed and developing countries, enabling knowledge sharing, technology transfer, and capacity building. Climate finance mechanisms, such as the Green Climate Fund, aim to foster solidarity and collective action, ensuring that the global community works together to address the climate crisis effectively.

Sources of Climate Finance

Climate finance refers to the funds that are allocated to projects or initiatives that mitigate or adapt to the impacts of climate change. The sources of climate finance can come from both the public and private sectors.

Public sources of climate finance

- Multilateral development banks (MDBs) such as the World Bank and the Asian Development Bank provide loans and grants to countries for climate-related projects. For example, the World Bank’s Climate Investment Funds have funded renewable energy projects in developing countries.

- Climate funds such as the Green Climate Fund which was established under the United Nations Framework Convention on Climate Change (UNFCCC) to support developing countries in mitigating and adapting to climate change. The fund has supported projects such as renewable energy in South Africa and climate-resilient agriculture in Nepal.

- National governments can also provide climate finance through their budget allocations or dedicated funds. For example, the UK government has established the International Climate Finance (ICF) fund to support developing countries in reducing greenhouse gas emissions and adapting to the impacts of climate change.

Private sources of climate finance include

- Climate bonds are fixed-income investments that finance projects with climate benefits such as renewable energy or energy efficiency. For example, Apple issued a $2.2 billion green bond in 2021 to fund renewable energy projects and reduce the company’s carbon footprint.

- Impact investing refers to investments made intending to generate positive social or environmental impacts and financial returns. Climate finance examples of impact investing include investing in renewable energy or sustainable agriculture projects.

- Corporate climate finance, where companies invest in climate-related projects to reduce their carbon footprint or meet sustainability targets. For example, IKEA has committed to investing $2.8 billion in renewable energy and energy efficiency projects by 2025.

The sources of climate finance are diverse and include both public and private sectors. From multilateral development banks to impact investing, there are many ways to finance climate-related projects and empower communities to take action against climate change.

Want to read more like this?

Get similar stories and a free sustainability checklist delivered to your inbox.

Like our content?

Get similar stories and a free sustainability checklist delivered to your inbox.

Climate Finance Instruments

Climate finance instruments are financial tools designed to support climate-related projects and initiatives. These instruments provide funding for projects that mitigate or adapt to the impacts of climate change. There are several climate finance instruments available, including:

Grants

They are financial awards provided to projects that meet certain criteria, such as environmental sustainability, social impact, or community benefit. Grants do not need to be repaid. Governments, non-profits, and foundations offer them.

Concessional loans

These are loans with lower interest rates or longer repayment terms than standard loans. These loans are often provided by multilateral development banks or government agencies and should support climate-related projects in developing countries.

Carbon finance

It involves the sale of carbon credits, which are certificates that represent a reduction in greenhouse gas emissions. These credits can be sold to companies or governments to offset their emissions, providing funding for climate-related projects.

Green bonds

They are bonds that are issued to fund environmentally sustainable projects. The proceeds from these bonds are earmarked for specific climate-related projects and are often issued by governments or corporations.

Climate insurance

It provides coverage for climate-related risks, such as drought, flood, or extreme weather events. This type of insurance can help communities and businesses recover from the impacts of climate change.

Equity investments

They provide funding for ownership in a project or company. This type of investment is often used to support clean energy or climate-related startups.

International Climate Finance Institutions

International climate finance institutions are organizations that provide financial support to address climate change and its impacts in developing countries. These institutions play a crucial role in mobilizing resources for climate-related projects and helping developing countries transition to low-carbon, climate-resilient economies. Here are some of the key international climate finance institutions:

Green Climate Fund (GCF)

The GCF is a global fund that supports developing countries in their efforts to mitigate and adapt to climate change. It provides grants, loans, and equity investments for projects that promote low-emission and climate-resilient development. The GCF is funded by contributions from developed countries and is governed by a board of representatives from developing and developed countries.

Climate Investment Funds (CIFs)

The CIFs are a set of funds that provide financing for climate-related projects in developing countries. The funds include the Clean Technology Fund (CTF), the Strategic Climate Fund (SCF), and the Forest Investment Program (FIP). The CIFs provide grants, loans, and guarantees for projects that promote low-carbon and climate-resilient development.

Global Environment Facility (GEF)

The GEF is a partnership of 183 countries that provides grants for environmental projects, including those related to climate change. The GEF provides funding for a range of projects, including renewable energy, energy efficiency, and climate adaptation measures.

Multilateral Development Banks (MDBs)

MDBs, such as the World Bank and the African Development Bank, provide financing for development projects in developing countries. Many MDBs have established climate finance initiatives, such as the World Bank’s Climate Investment Funds which provide funding for climate-related projects.

United Nations Development Programme (UNDP)

The UNDP provides support to developing countries to promote sustainable development and address climate change. The UNDP provides technical help and financing for climate-related projects. Including those related to renewable energy, energy efficiency, and climate adaptation.

European Bank for Reconstruction and Development (EBRD)

The EBRD provides financing for development projects in Central and Eastern Europe, and other regions. The EBRD has established a Green Economy Transition approach, financing projects promoting sustainable energy and low-carbon development.

These international climate finance institutions work to support the efforts of developing countries to address climate change and promote sustainable development. By providing financial resources, technical help, and capacity-building support, these institutions play a critical role in advancing the global transition to a low-carbon, climate-resilient future.

Challenges and Opportunities

The importance of climate finance in addressing climate change cannot be overstated. However, there are significant challenges that need to be addressed in order to mobilize sufficient financial resources and effectively implement climate finance initiatives. Here are some of the key challenges and opportunities related to climate finance:

Challenges:

- Lack of funding

Despite the growing importance of climate finance, there is still a significant funding gap, with many climate-related projects remaining underfunded. This is true for projects in developing countries, which often lack the financial resources to pursue climate-related initiatives.

- Limited access to financing

Many developing countries face challenges in accessing financing for climate-related projects. This is due in part to limited financial infrastructure, including banking and financial systems, as well as political and economic instability.

- Complex funding mechanisms

Climate finance initiatives often involve complex funding mechanisms, which can be difficult to navigate for developing countries. This can result in delays and difficulties in accessing funding.

- Political challenges

Climate finance is often subject to political considerations, with funding decisions influenced by geopolitical tensions and economic interests.

Opportunities:

- Innovation

The importance of climate finance has spurred innovation in financing mechanisms and financial products. These include green bonds, climate insurance, and carbon finance. These innovative approaches can help to mobilize additional financial resources for climate-related projects.

- Public-private partnerships

Public-private partnerships can help to leverage private sector financing for climate-related projects, while also addressing the challenges associated with complex funding mechanisms.

- Multilateral cooperation

International cooperation is essential to mobilize sufficient financial resources for climate-related projects. Multilateral organizations such as the UNFCCC, the GCF, and the MDBs play a key role in facilitating cooperation and coordination among countries.

- ESG investing

Environmental, social, and governance (ESG) investing has become increasingly popular, with investors seeking to align their investments with their values. This trend has created opportunities for financing climate-related projects, as investors look for opportunities to support sustainable development.

Takeaways!

In conclusion, climate finance plays a crucial role in addressing the urgent and complex challenge of climate change. By providing financial resources, technical help, and capacity-building support, climate finance initiatives help to promote sustainable development, reduce greenhouse gas emissions, and build resilience to the impacts of climate change. However, there are significant challenges that need to be addressed in order to mobilize sufficient financial resources and implement climate finance initiatives, including funding gaps, limited access to financing, complex funding mechanisms, and political challenges.

Fortunately, there are also significant opportunities for innovation, public-private partnerships, multilateral cooperation, and ESG investing that can help to overcome these challenges and unlock the potential of climate finance to promote a low-carbon, climate-resilient future. It is essential that we continue to prioritize and invest in climate finance and work together at the global, national, and local levels to build a sustainable and resilient future for all.

Incorporating climate finance into your sustainability strategy can help you unlock opportunities for innovation and growth while addressing the urgent challenge of climate change. Contact Ecowiser today to learn how our team of experts can help you navigate the complex landscape of climate finance and develop a customized strategy to achieve your sustainability goals.

Want to read more like this?

Get similar stories and a free sustainability checklist delivered to your inbox.

Like our content?

Get similar stories and a free sustainability checklist delivered to your inbox.